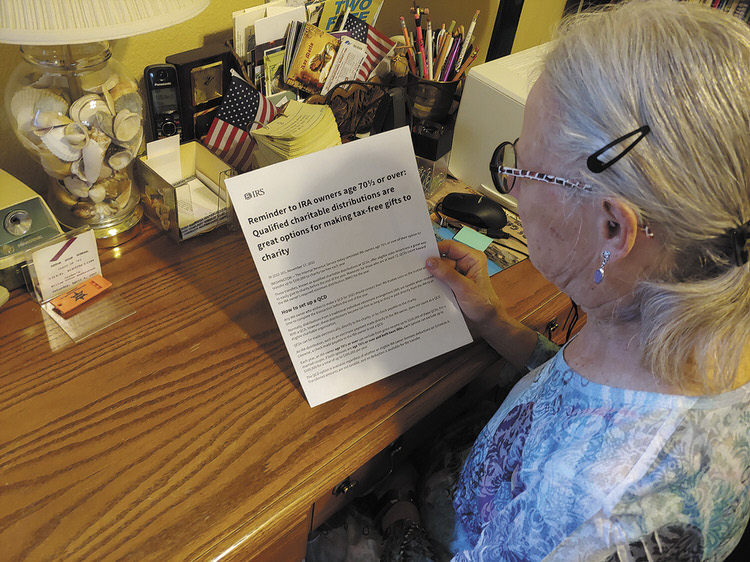

Peggy McGee, an IRS-certified AARP Tax Aide volunteer, reviews the IRS publication on QCD requirements. (Photo by John McGee)

Peggy McGee

Now that tax season is over, you may be looking for some ways to reduce your taxable income for Tax Year 2023. One way to do that is to make a qualified charitable distribution (QCD) to TWOQC for the Scholarship Program or other charity of your choice. The Women of Quail Creek’s Scholarship Program awards scholarships to high school students from Sahuarita, Walden Grove, and Rio Rico High Schools, as well as to women older than 21 who are returning to school to complete post-secondary education or are entering a new career field. All scholarships are needs based.

A QCD is a distribution from one’s individual retirement account (IRA) to a qualified charity. One must be age 70 1/2 or older to make a qualified charitable distribution. A QCD is not taxed, nor is it included in taxable income.

A QCD is a direct transfer of funds from an IRA custodian, payable to a qualified charity. Funds distributed directly to you (the IRA owner) and which you then give to charity do not qualify as a QCD. A QCD can be counted towards satisfying the required minimum distribution for the year. The QCD option is available for both those who take the standard deduction and those who itemize deductions. To make a contribution to TWOQC’s Scholarship Fund, please have the trustee make the check payable to TWOQC (Scholarship Program).

Please contact your financial advisor or IRA Trustee should you have questions about or to sign up to make a qualified charitable distribution.